Real Estate 101: Applying Elon Musk’s First Principles Thinking to Real Estate

How to use first principles thinking to analyse real estate deals or REITs in an evergreen methodology

How to use first principles thinking to analyse real estate deals or REITs in an evergreen methodology

First principles — unified theory of everything

I read the biography of Elon Musk during my second year of university. Before his entire idea on first principles thinking came about, my dad talked about it all the time when I did math in school. (My dad studied Aerospace Engineering at Glasgow University. I think it’s an engineering thing)

Nonetheless, the point stuck. And there was always some part of me that desired to find the unified field theory it seems. Like James Clerk Maxwell who formulated it in physics, and Michael Faraday who added on to it. Till this day, physicists have not come to a conclusion of a theory of everything that combines general relativity and quantum mechanics. (I found this unified theory in another form — Christianity. But let’s leave the story for another time.)

This explained why I enjoyed history and economics at school because there were fundamental first principles to which factor could be weighted more than others. Literature was somewhat similar in analysis, but tough to apply first principles to. The human psyche is not difficult to decipher, but becomes complex when we seek to be special and desire not to be understood.

Today, I apply this to real estate. Something very finance-y, and yet, still rooted in the human psyche.

Summary of points:

Why look at first principles in real estate?

Shows real fundamental analysis

Real estate is very human and emotional, not just bricks

Explains what’s happening in the market

I will analyse this based on 3 main points:

Sovereignty

Emotionality

Technology

1. Sovereignty

Tower of Babel. Source

Tower of Babel

Let’s look back to the first few pieces of real estate being built.

One similar to the Burj Khalifa today in the ancient world, is the Tower of Babel.

The story is familiar. These guys decide that hey they want to build a huge tower that reaches the heavens. And their motive is simple.

“And they said, Go to, let us build us a city and a tower, whose top may reach unto heaven; and let us make us a name, lest we be scattered abroad upon the face of the whole earth.” Genesis 11:4

Whatever people might say about real estate, you have to pull it back to the human psyche and the individual.

We want to make a name for ourselves, so that people can remember us and not forget us. In this, let us build it.

And…history has not changed. How many buildings, hospitals, universities, libraries are named after people in this world, or corporations? The Rockefeller Centre in New York, etc. In Singapore, we have OCBC Arena Singapore Sports Hub that became our national stadium (oh but what a failed project).

Make no mistake — Real estate is establishing one’s sovereignty and authority.

We can extend it further. Lands, roads, places. Europe named after Europa; Joo Chiat named after Chew Joo Chiat “King of Katong” (bet you didn’t know that).

The root of all this name-attached-to-places/buildings is not only that people remember us. It is tied to the idea of sovereignty. Big word. It just means sole authority.

Make no mistake — Real estate is establishing one’s sovereignty and authority.

Manorial system. Source

Power to the people post 1420s Black Death

Land is a factor of production, and you get rent as income. This idea of rent was somewhat new in the 1420s.

Prior to that was Feudalism or the manorial system. Around the world, whether you were under Genghis Khan or under Charlemagne, you served a minor King who owned his fief, and served the main King.

As a farmer, you tilled the land you lived on, and gave the spoils to your lord, who then distributes part of what you harvested back to you.

But things changed when the Black Death occured.

It spared the old, and hit the young. Lesser hands to work the fields. With less toil in the fields, meant less harvests to feed the population. Simple economics shows us that as supply falls, workers started pushing for higher wages.

More than that, they shaped the business model of real estate till today.

These serfs began to demand to “own” the land, by renting it from the landlord, but reaping the upside from the agricultural produce, while paying a fixed income.

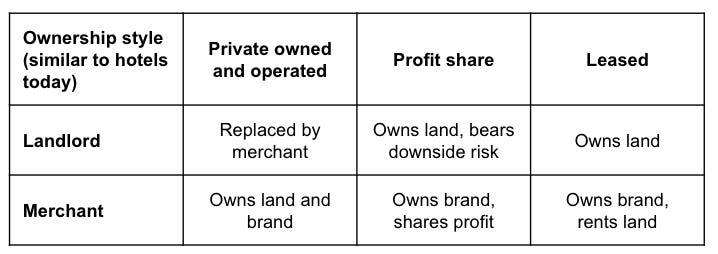

They created the 3 models of operating real estate, which is seen especially in hotels:

Private owned and operated — landlord was replaced by the serf, who became a “merchant”. This is uncommon, as one needed nobility status to own land

Profit share — 1400s Italy/France — Gross operating profit share between landlord and lessee. Landlord puts in land as equity, while serf puts in effort as equity; both share the upside and downside.

Leased — 1400s UK — The most common form today is in leasing the land, and then participating in the upside of the agricultural profits, while only paying a fixed income to the landlord

The Black Death shifted power back to the people, creating the idea of the landlord and the lessee in the UK, and the ideas of gross operating profit share in Italy/France — common business models in the hospitality real estate space today.

Thus, more power to the people after 1420s! They say there’s 1 pandemic every 100 years. With Covid in 2020, will there be more power to the people? Well, serfs in 1420 will never understand REITs — “how could I as an individual consumer own 0.001% of that massive shopping mall down the street?!”

2. Emotionality

I still recall sitting at the swing in the playground along Hougang, where I grew up with my grandaunt in the day. I went back when I was 16 and sat there in the same playground. The rubber swing was different compared to when I was 6. 10 years ago… things don’t last that long nowadays, do they?

I’m sure you feel the same nostalgia going back to old places you have been. Real estate is not a dead thing. They carry emotions. That’s why you won’t go back to that cafe you spent most of your time with your ex-girlfriend.

Hotels rising up in Boten bordertown at the Laos-China border.

Places carry memories. And more so to those who are displaced. In Boten, Laos, things have changed so rapidly that 200+ families are being relocated to New Boten, to build real estate to cater to the businessmen and trade that will occur at the border-town. In a documentary, when asked whether they miss their old town, they say yes. They walk back to visit and say that this building was where my house used to be.

People go back to what they are comfortable with.

If we were to analyse how real estate started. It is simple. Hunter-gatherers became settled farmers along fertile lands near volcanic soil and tributaries near the sea which allowed for trade. Our trade centers of the world in London, New York, Singapore, Hong Kong are what they are today in terms of high real estate valuation, because they contain such characteristics.

With that, came people who want to eke a living. Industrials for trade; residential for merchants who live there and eventually bring their families over; retail centers for enjoying the pleasures of life; and offices for the services that support the trade, such as lawyers, accountants and the such.

That’s how place-making starts; and real estate opportunists who look to rejuvenate a place should take good lessons on how to engineer such new towns. People go back to what they are comfortable with.

People go back to what they are comfortable with.

And this applies to the real estate moguls, the developers, the real estate private equity fund managers. They go back to what they are comfortable with and understand.

3. Technology

Technology has become a buzzword in real estate circles.

Use of optimising technology to cut operating expenses for tenants in electricity, water, utilities

Optimisation of how much square foot of space your company really needs with sensor technology

Co-working spaces that use real estate tech etc…

But we miss the point.

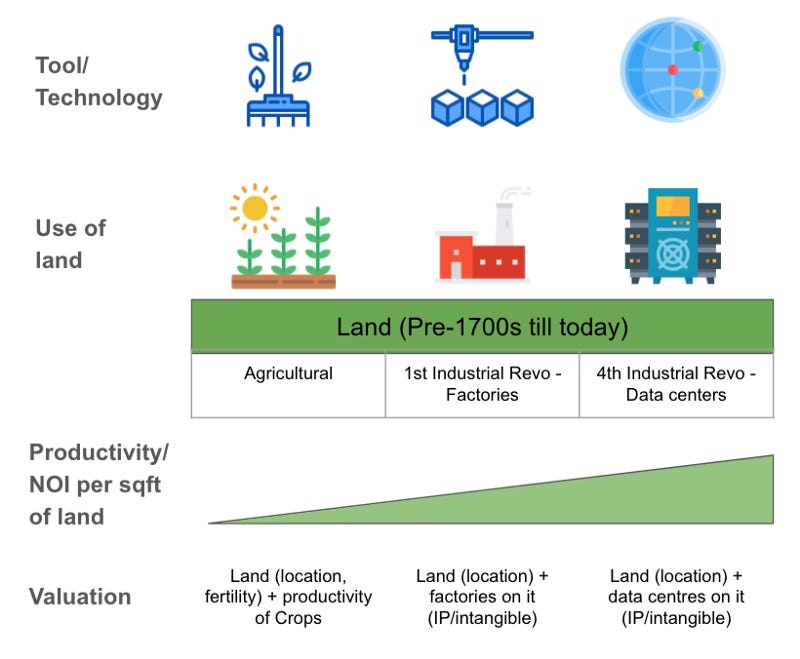

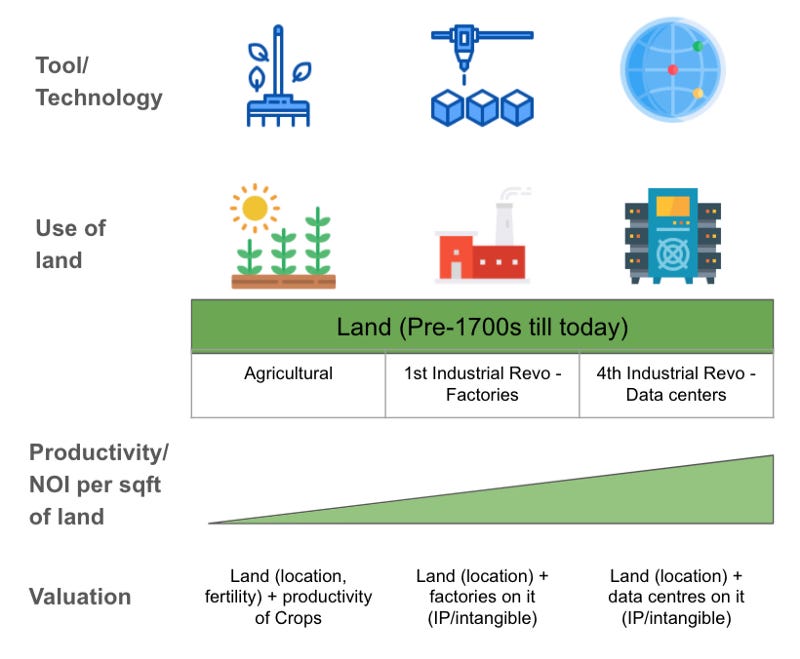

We forget that Technology directly influences the valuation of land.

The value of land increasingly prioritises the technology that is used on it. What does this mean?

1. Pre-1700s: harness sun’s energy for crops (agricultural)

We use land mainly for agriculture. We grow crops on it — potatoes, barley, wheat, corn

The tool you use to harvest is the rake. Back-breaking work

Some crops yield higher prices and more quantity than others. If you grow potatoes, they are high in value, nutritious and have less % of going bad than barley

The value of your land is determined by the net operating income of your harvested crop, which is dependent on price, quantity harvested, % going bad, etc., and most importantly how fertile the land is

2. 1700s: harness energy from coal (1st industrial revolution — factories)

Then, humans went through the 1st Industrial Revolution in the 1700s

We discovered coal, and steam engines

Land that’s not fertile could be used to build factories on it, making it valuable again (huge alpha gains)

Factories could be clothing mills, glass, cement, paper, etc.

The value of your land is determined by the net operating income of your factory’s produce, which is dependent on price, cost of goods sold, quantity produced, % going bad, etc.

Lesser of it is based on the land itself, but more on location and distance to consumers

3. Now: Rise of internet as digital real estate, supported by data centers (4th industrial revolution — data)

We’re now in the 4th Industrial Revolution — we discovered the Internet and the good and the bad of it (hello Dark web)

With the rise of 5G, people are more reliant on data than ever. Will data every become a market where consumers lose all bargaining power and price influencing power — it could be so

With high prices of cloud computing etc., most of the data center boys have the cash to pay higher rents → higher NOI (net operating income) → higher valuation

Again, less is based on fertility of the land, but location. Location to the interconnectedness to under-sea cables and grids, and also access to consistent power supplies

Thus, the valuation of the land is affected by technology, which people are willing to pay for, resulting in strong revenues (not a surprise that 109 of the F500 companies are in tech!), which results in being able to pay higher rents. With scarcer land that is closely connected to the cable and power grid, valuations shoot up.

Technology → Net operating income → valuation of the land

4. Future: REITs on Minecraft?

What is the future? Honestly I don’t know. But what I do know, is that Covid-19 has caused more to spend time in digital worlds than the real world. We still live in dimensions, where land and physical real estate is needed even in the digital world (we go back to what we are comfortable with).

With people selling accounts, or even skins in Counter-Strike that beautify their image, will people start selling constructed & developed properties on Minecraft? Who knows? What if we see a REIT on digital real estate in Minecraft in the future? One thing for sure is that Data Centre REITs in real life are going up with more people building real estate on Minecraft!

Or something that could happen in Singapore — vertical farming REITs? I was talking to an aquaculture accelerator this morning and the conversation was mainly about lack of usable land to do foodtech.

Conclusion

2 points: 1) Human Psyche and 2) What’s Possible

1) Sovereignty and 2) Emotionality helps you understand the human psyche

3) Technology helps you understand what’s possible

Piece them all together to understand real estate being built:

Where

How

When

Why

How would I apply this to my fundamental analysis of analysing a REIT, or a real estate deal?

I will support a:

Well-known brand (reputation/sovereignty), that

Understands a geography well (connections/emotionality), and

Understands how to harness technology in real estate